Forex trades, or foreign exchange trading, involve buying and selling currencies in the global marketplace. With its strength for high returns and the ability to trade 24 hours a day, forex trading has attracted many traders, from beginners to seasoned professionals. If you’re interested in entering forex in UAE, here’s a guide to help you get started.

Understand the basics of forex trading:

Before getting into forex trading, it’s essential to understand its fundamental concepts. The forex market is the largest financial market in the world, where currencies are traded in pairs, such as EUR/USD or GBP/JPY. Each currency pair consists of a base currency and a quote currency. The first currency is the base, while the second is the one you’re buying or selling. Understanding how these pairs work, along with concepts like pips (the smallest price movement) and spreads (the difference between the buying and selling price), is important for your trading journey.

Choose a reputable forex broker:

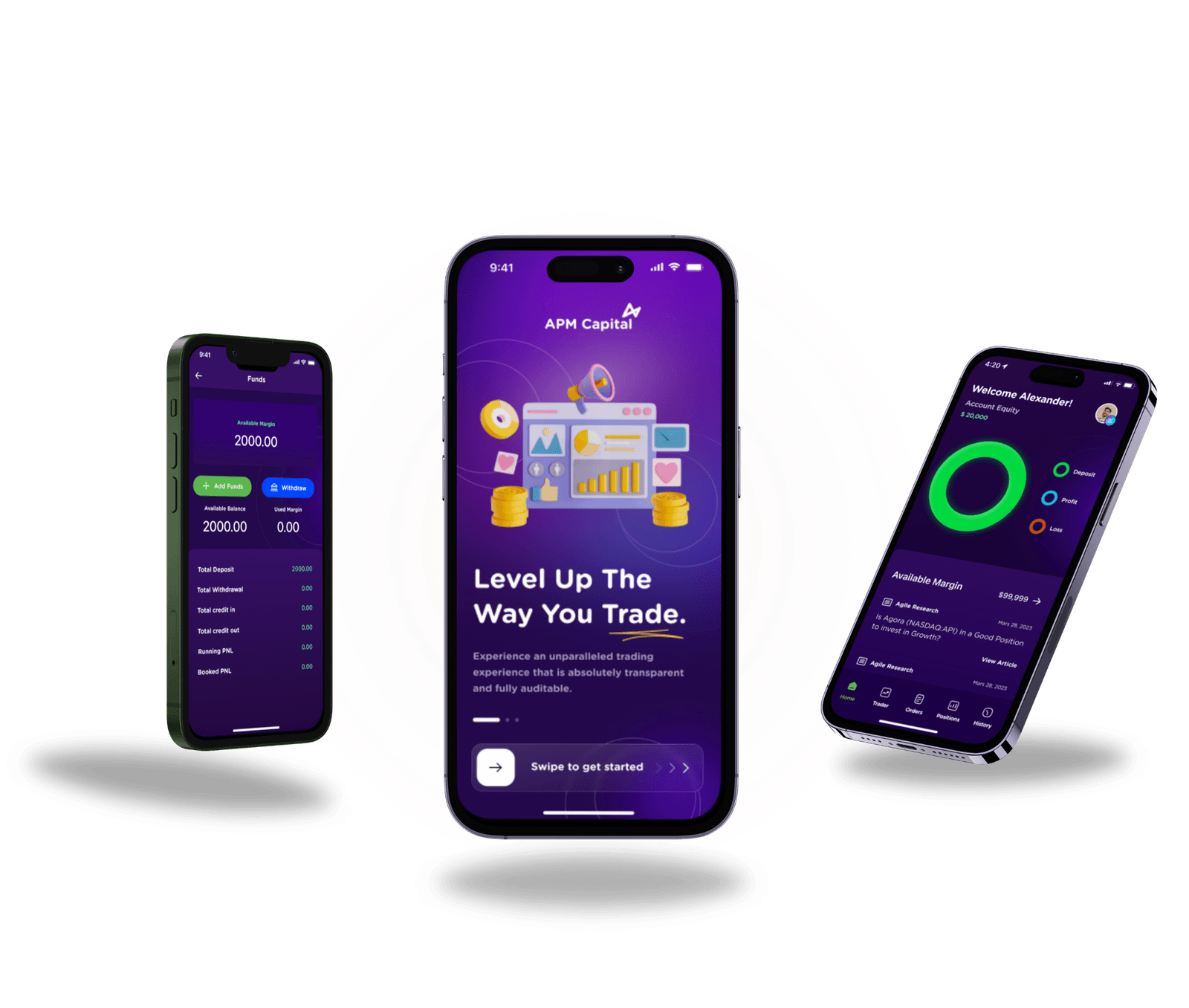

Selecting a trustworthy forex broker is vital to your trading success. A good broker should be regulated by a financial authority, offer a user-friendly trading platform, and provide a range of trading tools and resources. Look for brokers that offer competitive spreads, various account types, and excellent customer support. It’s advisable to read reviews and compare multiple brokers to find one that suits your needs.

Open a trading account:

Once you have chosen a broker, the next step is to open a trading account. Most brokers offer different types of accounts, including demo accounts, which allow you to practice trading with virtual money. Starting with a demo account is an excellent way to familiarize yourself with the trading platform and develop your skills without risking real money. After gaining confidence, you can transition to a live trading account.

Learn about risk management:

Effective risk management is important in forex trading. Determine how much capital you are willing to risk on each trade and set appropriate stop-loss orders to limit losses. A common guideline is to risk no more than 1-2% of your trading capital on a single trade. Understanding how to manage your risk will protect your account and ensure long-term sustainability.